Mistakes happen in any business, and banks and credit unions are no exception. Although it’s unlikely, it is possible for a deposit to be mistakenly credited to the wrong person’s account. … What happens if you accidentally deposit a check twice? If you accidentally deposit a check twice, the bank will remove the duplicate transaction. It’s

What happens when you mobile deposit the same check twice – YouTube

Maybe. If the check was not indorsed “for mobile deposit” when it was deposited with your teller, your bank can make an indemnity claim under Regulation CC to recover the amount of the check from the check that accepted the mobile deposit of the check.—–Learn more about John Burnett’s webinar Avoiding Check Losses

Source Image: wfmynews2.com

Download Image

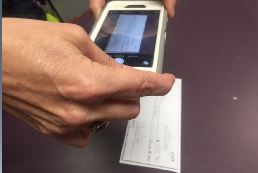

The check was first deposited by the charity virtually by simply pointing, shooting and clicking using a remote deposit app. But the second time, an employee went to the bank and mistakenly deposited the same check, number 1027, again. No banks caught the duplicate deposit, and the account was debited twice.

Source Image: m.youtube.com

Download Image

6 Ways to Deposit Checks – wikiHow Accidentally or on purpose, your check could get deposited twice if someone uses mobile banking to deposit it first. Credit: WFMY If you still write checks, you need to read this story.

Source Image: m.youtube.com

Download Image

What Happens If You Accidentally Deposit A Check Twice

Accidentally or on purpose, your check could get deposited twice if someone uses mobile banking to deposit it first. Credit: WFMY If you still write checks, you need to read this story. A duplicate deposit occurs when a someone deposits the same check twice, or deposits it and then also attempts to cash it. This is typically done by first depositing an image of the the check electronically, then attempting to deposit or cash the original paper check separately. This practice was not possible for members of the general public

✓ What To Do With Check After Mobile Deposit? 🔴 – YouTube

In the Martens’ case, the double deposits — known in the industry as double presentment — happened 17 times. They were tipped off by an employee who accidentally deposited the same cheque What happens when you mobile deposit the same check twice? – YouTube

Source Image: m.youtube.com

Download Image

7 Reasons Your Mobile Check Deposit Can Be Rejected | PrimeWay Federal Credit Union In the Martens’ case, the double deposits — known in the industry as double presentment — happened 17 times. They were tipped off by an employee who accidentally deposited the same cheque

Source Image: primewayfcu.com

Download Image

What happens when you mobile deposit the same check twice – YouTube Mistakes happen in any business, and banks and credit unions are no exception. Although it’s unlikely, it is possible for a deposit to be mistakenly credited to the wrong person’s account. … What happens if you accidentally deposit a check twice? If you accidentally deposit a check twice, the bank will remove the duplicate transaction. It’s

Source Image: m.youtube.com

Download Image

6 Ways to Deposit Checks – wikiHow The check was first deposited by the charity virtually by simply pointing, shooting and clicking using a remote deposit app. But the second time, an employee went to the bank and mistakenly deposited the same check, number 1027, again. No banks caught the duplicate deposit, and the account was debited twice.

Source Image: wikihow.com

Download Image

What happens when you mobile deposit the same check twice? – YouTube Whether accidentally or on purpose, check recipients can now cash or deposit the same check multiple times — and if you don’t catch it right away, you might have to pay. Consumer advocate and

Source Image: m.youtube.com

Download Image

Citizens Bank customer gives someone a $100 check, it clears twice: Money Matters – cleveland.com Accidentally or on purpose, your check could get deposited twice if someone uses mobile banking to deposit it first. Credit: WFMY If you still write checks, you need to read this story.

Source Image: cleveland.com

Download Image

Damaged Check: What to Do With a Torn or Ripped Check A duplicate deposit occurs when a someone deposits the same check twice, or deposits it and then also attempts to cash it. This is typically done by first depositing an image of the the check electronically, then attempting to deposit or cash the original paper check separately. This practice was not possible for members of the general public

Source Image: financialwolves.com

Download Image

7 Reasons Your Mobile Check Deposit Can Be Rejected | PrimeWay Federal Credit Union

Damaged Check: What to Do With a Torn or Ripped Check Maybe. If the check was not indorsed “for mobile deposit” when it was deposited with your teller, your bank can make an indemnity claim under Regulation CC to recover the amount of the check from the check that accepted the mobile deposit of the check.—–Learn more about John Burnett’s webinar Avoiding Check Losses

6 Ways to Deposit Checks – wikiHow Citizens Bank customer gives someone a $100 check, it clears twice: Money Matters – cleveland.com Whether accidentally or on purpose, check recipients can now cash or deposit the same check multiple times — and if you don’t catch it right away, you might have to pay. Consumer advocate and